At the RSA 2024 event in San Francisco this year one of the key areas addressing the fintech marketplace both for banking and for institutional investors was security operating on a container basis.

Historically a lot of the applications for fintech were run on large servers and then they ended up running on distributed platforms but ending up operating through base web operations now with the advent of smartphones as the primary input device self-contained apps are the key data transfer mechanisms

These apps on the smartphones not only contain the data but also contain the programs that will be run and the reporting mechanisms to the government the banks and the user.

As Fintech moves to larger applications the security aspects and privacy aspects move to the forefront.

At the RSA 2024 event many companies were now showing that they could provide tracking and security solutions 4 containers and apps distributed across devices to be able to ensure the fintech community could operate in relative safety.

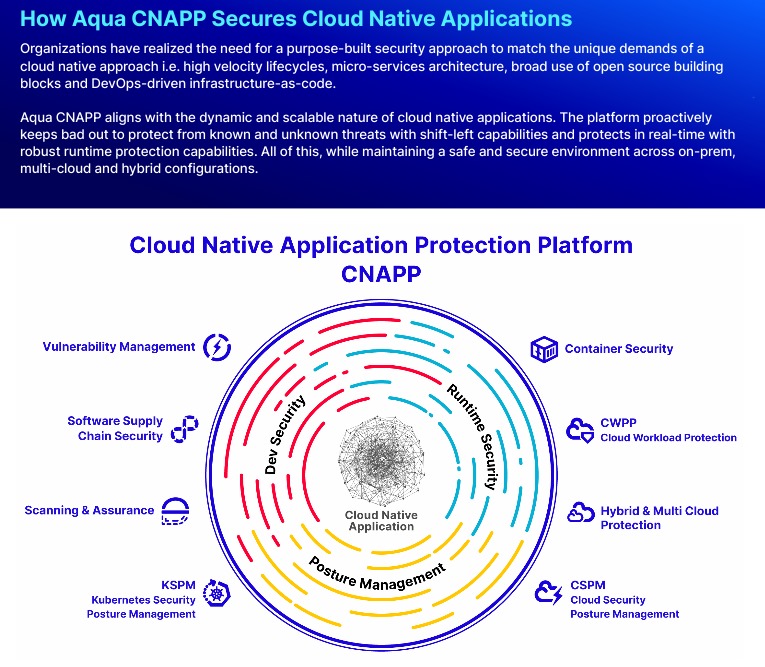

One of the leaders in this space is Aqua IT solutions which has a full product solution space for tracking use and the distribution of containers and their associated data from financial institution to user and back.

This is an important step as more companies move to add line account management handling their own credits and gift cards and the financing behind coupon systems

Also supported the solution is companies like Arista that has security built into there’s Software Controlled Networking Equipment, MasterCard which was showing their data intelligence group that helps interpret transaction verification, next DLP which is monitoring the data along the way to make sure that it is not interrupted or corrupted, and member companies from the Thoma Bravo group which has long supported the fintech community.

The ability to bring security to the container deployment marketplace is a key stop as embedded video, training and customer support is moving to more AI and less people base solutions.